1. Analytical mindset

There is no way around it – this job requires a great deal of analysis at all levels: the individual investment, the portfolio as an aggregate, the macroeconomic environment, etc. On top of that, all these individual observations need to be puzzled into a cohesive view of the optimal portfolio construction and strategy.

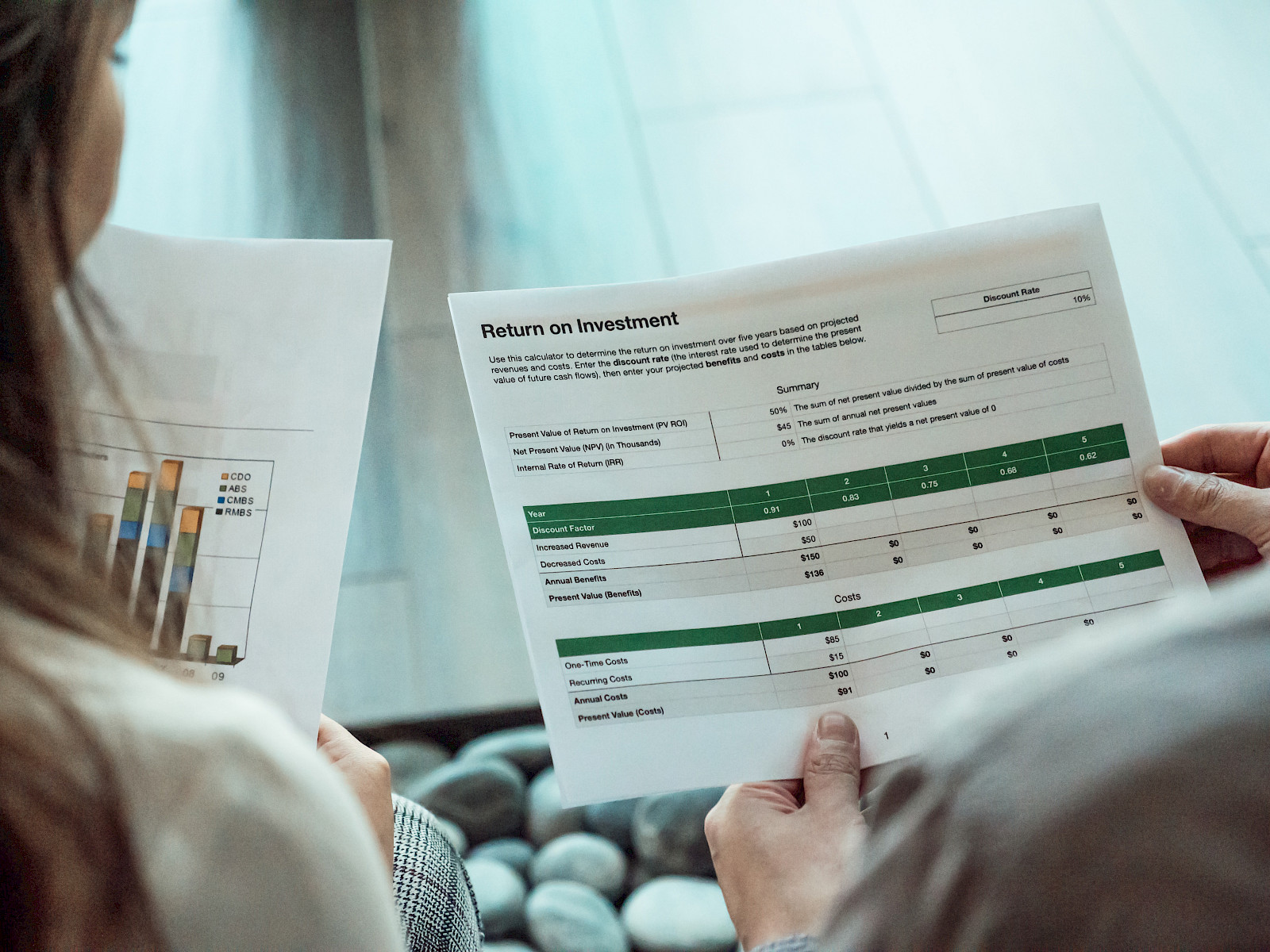

2. Financial know-how

Many of the individual types of analysis we use on the daily are based on the understanding of financial statements, corporate finance, and financial valuation techniques. A portfolio needs to undergo periodic valuations for auditing purposes, which translates (at least, as of today) into the need for sharp MS Excel skills.

3. Presentation skills

You will conduct your analysis, prepare financial considerations and - yes – you will be presenting them a lot. Your future audience will include your general partners, limited partners, entrepreneurs in the portfolio companies, co-investors in a follow-on round and many more. Using programs like MS PowerPoint, amongst others, you will need to be proficient in presenting fact and data-based statements, structured thoughts through the right figures with clarity and assertiveness.

4. Relationship management

Importantly, this role is anything but back-office. On the contrary, it requires building long-term and trusted relationships. The most important ones are those with entrepreneurs in portfolio companies. Maintaining a fluid dialogue and supporting them in a timely manner is is undoubtedly a key part of the role – without which, all the analysis and presenting serves little purpose.

Maintaining a professional relationship is also important with several other stakeholders, such as co-investors, business and commercial partners, service partners and more.

5. Project management

Given all the above, intuitively this role requires a great deal of professional juggling: all portfolio-related activities are happening in parallel, on a continuous basis (often, at rocket speed) and require constant attention. Therefore, multi-tasking and priority-shifting are necessary skills. Teamwork, internal communication, timeline management are also key. On the practical side, this boils down to being fluent in modern collaboration and productivity tools – particularly those that made the modern hybrid work style possible.

If you are considering to join the venture capital world and have some open questions: feel free to send them to info@serpentine.vc. I will pick up your questions in a later article.